Still just a one-off or nah? 👀

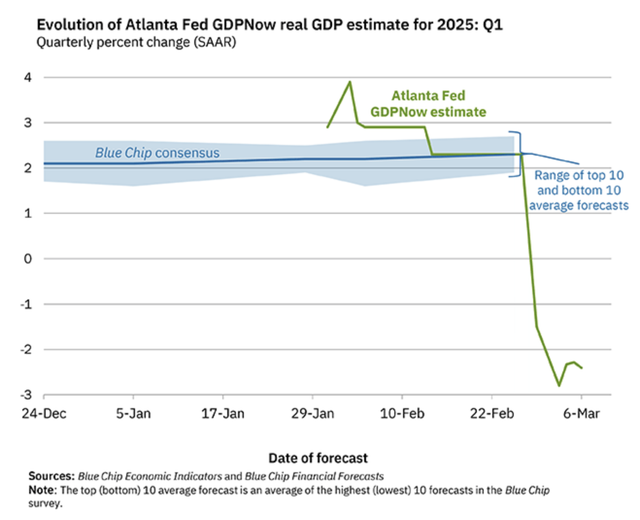

The Atlanta Fed GDPNow real #GDP estimate for 1Q 2025 is currently:

-2.4% (that's negative 2.4%, son)

OPINION:

- US economy looking a bit ugly at the moment, after leading the world to the upside for much of 2023 and 2024.

- The world ex-US is looking pretty solid, actually.

- Global assets may continue to outperform, while US-based assets may struggle for a bit.

Just my two sats. ⚡

The Atlanta Fed GDPNow real #GDP estimate for 1Q 2025 is currently:

-2.4% (that's negative 2.4%, son)

OPINION:

- US economy looking a bit ugly at the moment, after leading the world to the upside for much of 2023 and 2024.

- The world ex-US is looking pretty solid, actually.

- Global assets may continue to outperform, while US-based assets may struggle for a bit.

Just my two sats. ⚡

Liquidity is more important and that's been rising since January. Nearly out of the November-December liquidity air pocket now. This could have an impact on future credit growth. it depends on the breakdown and reasoning of the decline.

Or importers are front running tariffs, PCE may not contract in Feb and March just because it did in Jan and as more data becomes available the estimate will revert to the mean. This forecast is an outlier so probably better to look into why that might be the case

Here are my two € cents.

The market is pricing in the scenario of “a protectionist USA in a multi-polar world”. In this scenario USA is overvalued, and Europe is undervalued.

Let me elaborate. The US vs the rest trade war is seen here as something that will primarily hurt the US. Because the rest will increase trade among themselves to offset trade lost with the US, while in the US not only imports will become pricier, but internal products as well due to the wrecking ball being put to the North American supply chains. Eventually this might lead to some US sectors becoming stronger, but I don’t think the market believes that this eventually is anywhere near now.…

The market is pricing in the scenario of “a protectionist USA in a multi-polar world”. In this scenario USA is overvalued, and Europe is undervalued.

Let me elaborate. The US vs the rest trade war is seen here as something that will primarily hurt the US. Because the rest will increase trade among themselves to offset trade lost with the US, while in the US not only imports will become pricier, but internal products as well due to the wrecking ball being put to the North American supply chains. Eventually this might lead to some US sectors becoming stronger, but I don’t think the market believes that this eventually is anywhere near now.…

Still bearish after tonight or nah?

I am highly skeptical of all the numbers the government puts out. My base case is they always skew in their favor (regardless of party). There are just to many assumptions in the numbers and the underlying unit or account is manipulated. So......how accurate can they be? BTW, I am not saying there won't be a contraction in GDP just that is difficult to assess all the implications of this and how the numbers are arrived at to begin with......I mean we have just seen that many of the payments leaving the government can't be traced and we don't even know why the payment was made......

So orange coin may still do well then? If rest of the world is doing well and pumping liquidity (China), Bitcoin should benefit.

Hide replies

pretty sizable adjustment for some bright economists

is bitcoin one of these "global assets" you speak of?

Hide replies

Hide replies

GDPNow is a useful real-time estimate, but it's volatile early in the quarter. That said, a **-2.4% contraction** would be a **big shift** from the strong growth of 2023-24.

A few thoughts:

1. **US Weakness** – The Fed's tightening cycle could finally be biting. High rates, slowing consumer demand, and sticky inflation (especially in services) might be dragging down growth.

2. **Global Strength** – Europe and emerging markets, especially commodity-exporting nations, could see relative outperformance if the US slows and the dollar weakens.

3. **Market Impact** – If this contraction trend holds, the Fed might pivot sooner than expected, which could shift capital flows into risk assets (especially global ones).

Short-term noise or start of something bigger? We’ll see. But definitely a number to watch. ⚡

A few thoughts:

1. **US Weakness** – The Fed's tightening cycle could finally be biting. High rates, slowing consumer demand, and sticky inflation (especially in services) might be dragging down growth.

2. **Global Strength** – Europe and emerging markets, especially commodity-exporting nations, could see relative outperformance if the US slows and the dollar weakens.

3. **Market Impact** – If this contraction trend holds, the Fed might pivot sooner than expected, which could shift capital flows into risk assets (especially global ones).

Short-term noise or start of something bigger? We’ll see. But definitely a number to watch. ⚡

Negative real productivity or @Jeff Booth -esqe deflation?

GDP is a fake metric, it doesn't tell anything concrete about the true health of the economy, especially in coumtries where it's all bloated with government numbers.

Hide replies

It doesn't matter if it's fake, most of the market trades based on it and other fake metrics such as CPI. So it still affects Bitcoin.

Hide replies

Hide replies

Not in terms of how they affect markets, at least nominally

"Global assets" meh.

Feel like I'd rather US bonds, Gold.

Nowhere else excites me.

Jobs will hurt a little. But I think the US economy needs a cleansing. Controlled and intentional is the best way. They just need to stand their base.

I think most of the pain will be felt by lazy democrats, so I'm hopeful they'll stick to it.

Plus, Trumps and Musk are personally incentivized to lower rates. So as long as inflation stays low (it will) they probably can't be arsed about a recession.

Feel like I'd rather US bonds, Gold.

Nowhere else excites me.

Jobs will hurt a little. But I think the US economy needs a cleansing. Controlled and intentional is the best way. They just need to stand their base.

I think most of the pain will be felt by lazy democrats, so I'm hopeful they'll stick to it.

Plus, Trumps and Musk are personally incentivized to lower rates. So as long as inflation stays low (it will) they probably can't be arsed about a recession.

I'm no economist, but I think the scenario playing out whereby the US shrinks +2%, and globally everyone else remains resilient, is unlikely.

This may be the thing or 'message' that makes the current inbumbents over there rethink their "find $1Trn in cuts" though lol.

This may be the thing or 'message' that makes the current inbumbents over there rethink their "find $1Trn in cuts" though lol.

Hide replies

GDP isn't a measure of resilience though. It's a measure of output, usually done by printing money. So a country printing a dick load of money can look great in terms of GDP. Fiat games.

Hide replies

Yeh, you are right about that. Bit of an odd metric to use too, as it doesn't really account for population growth or reduction.

i.e. population doubles, GDP stays the same, everyone on aggregate is poorer lol.

Fiat games indeed.

i.e. population doubles, GDP stays the same, everyone on aggregate is poorer lol.

Fiat games indeed.

The world is a disaster. Japan, China, Germany, the rest of the EU, mexico and Canada with tariffs issues. There is no good news anywhere in developed nations.