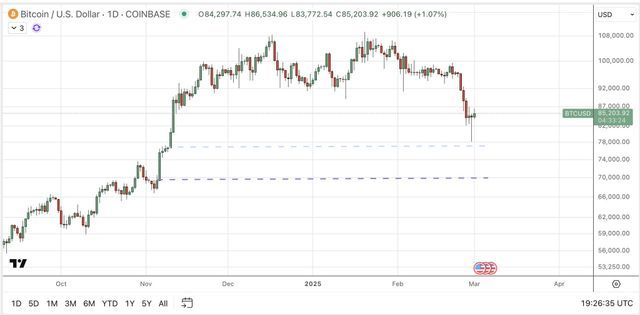

🚨 Example of a derivative's impact on #Bitcoin.

🟠 BTC (spot) trades 24/7

🟢 FBTC (ETF) follows TradFi market hours

Because of the time differences, FBTC showed a series of gaps that ultimately traders like to fill. It's called "filling the gap".

Now, BTC’s spot market is working to 'fill the gap.' (light blue & purple zones)

This is the first cycle with a full set of Wall Street tools being used to shape BTC price action: Futures, ETFs & Options.

💡Different market psychologies = new reactions

These gaps highlight a key lesson: Derivative markets can influence spot price action & provide clues.

The psychology behind Futures, ETFs & Options traders differs from spot buyers. As these instruments grow, their impact on Bitcoin’s price cycles is becoming more significant. This can be seen in Bitcoin's changing volatility profile as well.

Understanding this dynamic helps traders anticipate key price moves.

Bitcoin's changing volatility profile:

🟠 BTC (spot) trades 24/7

🟢 FBTC (ETF) follows TradFi market hours

Because of the time differences, FBTC showed a series of gaps that ultimately traders like to fill. It's called "filling the gap".

Now, BTC’s spot market is working to 'fill the gap.' (light blue & purple zones)

This is the first cycle with a full set of Wall Street tools being used to shape BTC price action: Futures, ETFs & Options.

💡Different market psychologies = new reactions

These gaps highlight a key lesson: Derivative markets can influence spot price action & provide clues.

The psychology behind Futures, ETFs & Options traders differs from spot buyers. As these instruments grow, their impact on Bitcoin’s price cycles is becoming more significant. This can be seen in Bitcoin's changing volatility profile as well.

Understanding this dynamic helps traders anticipate key price moves.

Bitcoin's changing volatility profile: